|

The whole world is moving towards dismantling barriers to trade. The largest barriers to Indian trade have been its tax systems. Harmonization of the taxation systems through initiatives like value added tax is a crucial step in the unification of domestic markets and boosting trade and commerce. The “value added tax” (VAT) has been adopted across the world in various forms. Forty years ago, no more than ten countries had VAT, whereas now, the global spread of VAT has reached to more than 150 countries. |

India too has modified its tax regime from Sales Tax/Central Excise to VAT models. The first phase of reform of indirect taxation occurred when the Modified Value Added Tax (MODVAT) was introduced for selected commodities at the central level in 1986, and then gradually it was extended to all commodities through Central Value Added Tax (CENVAT). Reforms at the State levels started through introduction of Value Added Tax (VAT). Haryana being the first Indian State to implement VAT in 2003 and Uttar Pradesh switched to VAT in January 2008 to complete the Indian experiment for a nation-wide State-level VAT.

The VAT experience so far has been positive throughout India. Despite this success, there are still certain shortcomings in the prevailing VAT system in India such as non-inclusion of several level indirect taxes in the main VAT fold; b) cascading of taxes due to absence of seamless tax supply chain; and c) destination level taxation across board not incorporated.

During the budget session of 2007-2008, the Finance Minister of India, declared that the journey of tax reforms won't end with just VAT implementation, but, this would go beyond - towards implementation of an integrated “goods and services tax” (GST) effective from April 01, 2010. Though, the set target for GST has been missed, now, there is a likelihood that it would be implemented from 2011.

What is GST?

Goods and Services Tax (GST) is a comprehensive multi-stage value added tax on goods and services.It is collected on value added at each stage of sale or purchase.No differentiation between Goods and Services as GST is levied at each stage in the supply chain.Seamless input tax credit and tax on transactions is framed in such a way that only the end customers who consume the goods or services bear the final cost of the tax.

Generally, same rate of GST applies on goods and services. The application of the destination principle (required by international trading norms) ensures the external neutrality of VAT and tax is charged on the consumption of goods and services within the jurisdiction where the consumption takes place. Exports are zero-rated and imports are taxed on the same basis and at the same rate as local production.

Gains from GST:

1. Emergence of a single common market in the whole country.

2. A simple tax structure with only few tax rates.

3. Increased tax revenues due to wider tax base and better compliance.

4. Do away ambiguity that comes due to the overlapping nature of goods and services.

5. Removal of the inter-state tax irritants that hamper the free flow of goods.

6. Reduce manufacturing cost as setoff available right from production to consumption.

7. Tax on imports result in a level playing field for local manufacturers and traders.

The Indian story so far:

Phase-I, Sales Tax (ST):

A tax on the sale and purchase of goods was not unknown even five thousand years before when Manu compiled his xe "Manu-Smriti"Manu-Smriti - the Code of Laws of Manu. Modern sales tax, however, is said to be a product of First Great War - when the Governments, per force, had to reinforce their exchequers on account of the financial exigencies of the war. France introduced it in 1914, followed by Germany (1916), Canada (1920), Russia (1921); Italy (1923), Australia (1930), New Zealand and America (1933).

The Government of India Act, 1935, made ‘Tax on the sales of goods' a provincial subject and provincial autonomy was introduced in India in 1937. States had to think of new avenues for balancing their budgets and it was the State of Madras that firstly enforced a general sales tax in the year 1939. One by one, other Indian States followed suit.

|

Chronology of indirect taxation on Goods & Services in India |

|

Year |

Milestone |

|

1935 |

Govt of India Act, 1935 made tax on sales of goods a provincial subject |

|

1939 |

Sales Tax introduced in India in the State of Madras |

|

1941 |

Sales tax introduced in the State of Punjab |

|

1974 |

LK Jha Committee suggests VAT |

|

1986 |

MODVAT introduced in India from 1st of March on select commodities |

|

1991 |

Chelliah Committee recommends VAT |

|

1994 |

Introduction of Service tax in India |

|

1999 |

FM announces decision to introduce VAT in India.

Formation of Empowered Committee on VAT |

|

2002 |

Task Force on Indirect Taxes report headed by Kelkar.

CENVAT introduced on all commodities at central level |

|

2003 |

VAT introduced in first Indian State of Haryana |

|

2005 |

VAT in 24 States/UTs including Punjab, Chandigarh, HP, J&K and Delhi. |

|

2006 |

VAT implemented in 5 more States including Rajasthan. |

|

2007 |

FM announces GST introduction in India from April 01, 2010.

VAT implemented in Tamil Nadu & Puducherry.

Central Sales Tax (CST) phase out starts, CST cut to 3%.

Joint Working Group set up for proposing GST roadmap and structure. |

|

2008 |

VAT introduced in the last Indian State of UP from January 01, 2008.

CST reduced to 2% |

|

2009 |

Empowered Committee released First Discussion Paper on GST on November 10.

Report of Task Force on GST of 13th Finance Commission on December 15.

Report of 13th Finance Commission (TFC) on December 29 - Chapter 5 on GST. |

|

2010 |

Proposed date to introduce GST in India postponed to April 01, 2011. |

Phase-II, Value Added Tax (VAT):

In 1986, MODVAT – a restricted form of VAT for select commodities was introduced at central level. In 1994, Service Tax came into existence. CenVAT was implemented for all commodities in 2002-03. In a meeting of all State CMs November 16, 1999 by the then union Finance Minister, it was decided to take steps for introduction of State level harmonized VAT and Empowered Committee of State Finance Ministers (EC) was formed in this regard. In a meeting of EC on 18th June 2004 a broad consensus was arrived to introduce State level VAT starting from 1st of April 2005. Following this, 22 States/UTs (Maharashtra, West Bengal, Karnataka, Kerala, Andhra Pradesh, Goa, Delhi, Punjab, Orissa, Assam, Sikkim, Meghalaya, Tripura, Arunachal Pradesh, Manipur, Jammu & Kashmir, Mizoram, Nagaland, Bihar, Himachal Pradesh, Dadar & Nagar Haveli and Daman & Diu) introduced VAT from April 1, 2005. Uttaranchal adopted VAT from October 1, 2005. Chandigarh introduced VAT from December 15, 2005. Haryana implemented VAT way back on April 1, 2003 and its structure is slightly different from others. Andaman & Nicobar and Lakshadweep do not levy VAT. Five States of Chattisgarh, Gujarat, Jharkhand, Madhya Pradesh and Rajasthan implemented VAT from 1st of April 2006. Effective from first January 2007, VAT was introduced in Tamil Nadu. Puducherry also followed from July 01, 2007. Finally, the last Indian State, Uttar Pradesh, switched to VAT fold from January 2008. Despite the initial transitional problems, the implementation of VAT had been smooth and encouraging. The rate of growth of tax revenue has nearly doubled from the average annual rate of growth in the pre-VAT five year period after the introduction of VAT. Industry and trade has also responded to VAT regime positively.

Phase-III, Goods and Services Tax (GST):

The next significant step of India's indirect tax reforms is to introduce an integrated VAT on Goods and Services or in other words Goods and Services Tax (GST). On these lines, an announcement was made by the Union Finance Minister in the Budget session of 2007-08 that GST in India would be introduced from April 01, 2010. The Taxation Law (Amendment) Act, 2007 started the process of phasing out in stages the Central Sales Tax (CST) and eventually abolish it. The Empowered Committee of State Finance Ministers (EC) further constituted a Joint Working Group (JWG) comprising of Finance & Revenue Secretaries, which submitted its report on November 19, 2007. Based upon this report and comments received from various State Governments and Government of India, a working group of officials was constituted by the EC so as to prepare a road map and model on GST. The EC has taken a detailed view on the recommendations of this working group and has released First Discussion Paper on GST on November 10, 2009, for discussion with industry, trade and people at large. The Thirteenth Finance Commission has also given its report on GST on December 29, 2009. Though, the set target for GST has been missed, now, there is a likelihood that it would be implemented from April 01, 2011.

How most of the globe is operating

Brazil was the first country to adopt VAT system in the year 1967. In 1970's it was introduced in the European countries. In Asia, it was adopted by Pakistan in 1990, Bangladesh in 1991, China in 1994, and Nepal in 1997. In Europe, adoption of VAT was made a condition for membership of EC, due to this Europe could create a single market by abolishing fiscal frontiers. In SAARC countries, only Afghanistan and Myanmar has still sales tax laws. All the OECD (organisation for economic cooperation and development) member countries except the United States has implemented VAT.

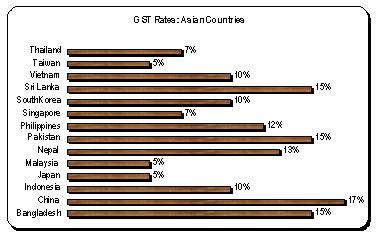

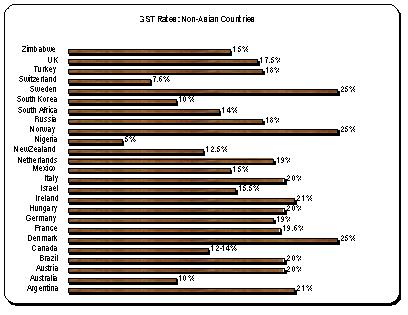

Standard GST rate in most of the countries ranges between 15 to 20%. Taxation is on all sectors with very few exceptions. There is full tax credits on inputs. Countries like Australia, New Zealand and European Union have adopted a single unified GST as a common tax on goods and services, while, countries like Canada and Brazil have adopted a dual GST where the tax is levied by both the central and the provincial governments. In Canada, GST (known as HST-Harmonized Sales Tax) varies from 12-15%. Average national GST in Brazil is 20%. Average GST rate of European Countries is around 19% and the average GST of OECD countries is around 18%. India has preferred the Canadian to the Brazilian model.

|