GST E-Way Bill Draft Rules issued

GST - CBEC has issued further Draft Rules

The following further draft Rules have been made available

1.

Accounts and Records

2.

Advance Ruling

3.

Appeals and Revision

Click to download the GST Draft Rules

Migration to GST Mandatory for Service Tax Return

CBEC has required the Service Tax Assessees to confirm migration of registration to GST to enable filing of service tax returns due to be filed by 25th April,2017.

Click to view communication of CBEC requiring confirmation of migration of registration to GST

Assessees who have

initiated migration of registration to GST are required

to enter details of their user name entered in GST

Portal for migration of registration to GST.

For carry forward of input credits from existing taxation system to GST, it is essential to migrate registration to GST on or before 30/04/2017.

Date : April

20, 2017

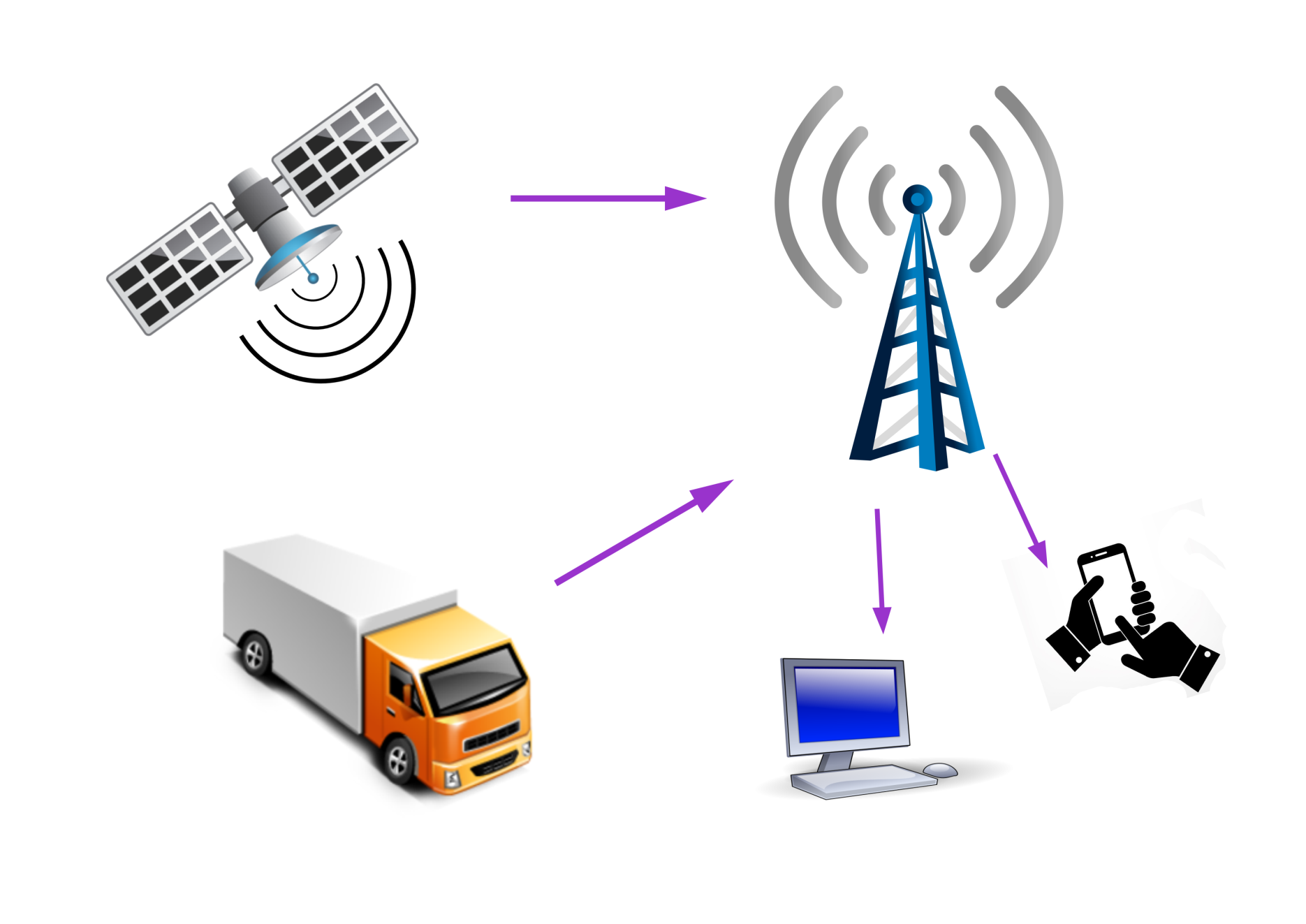

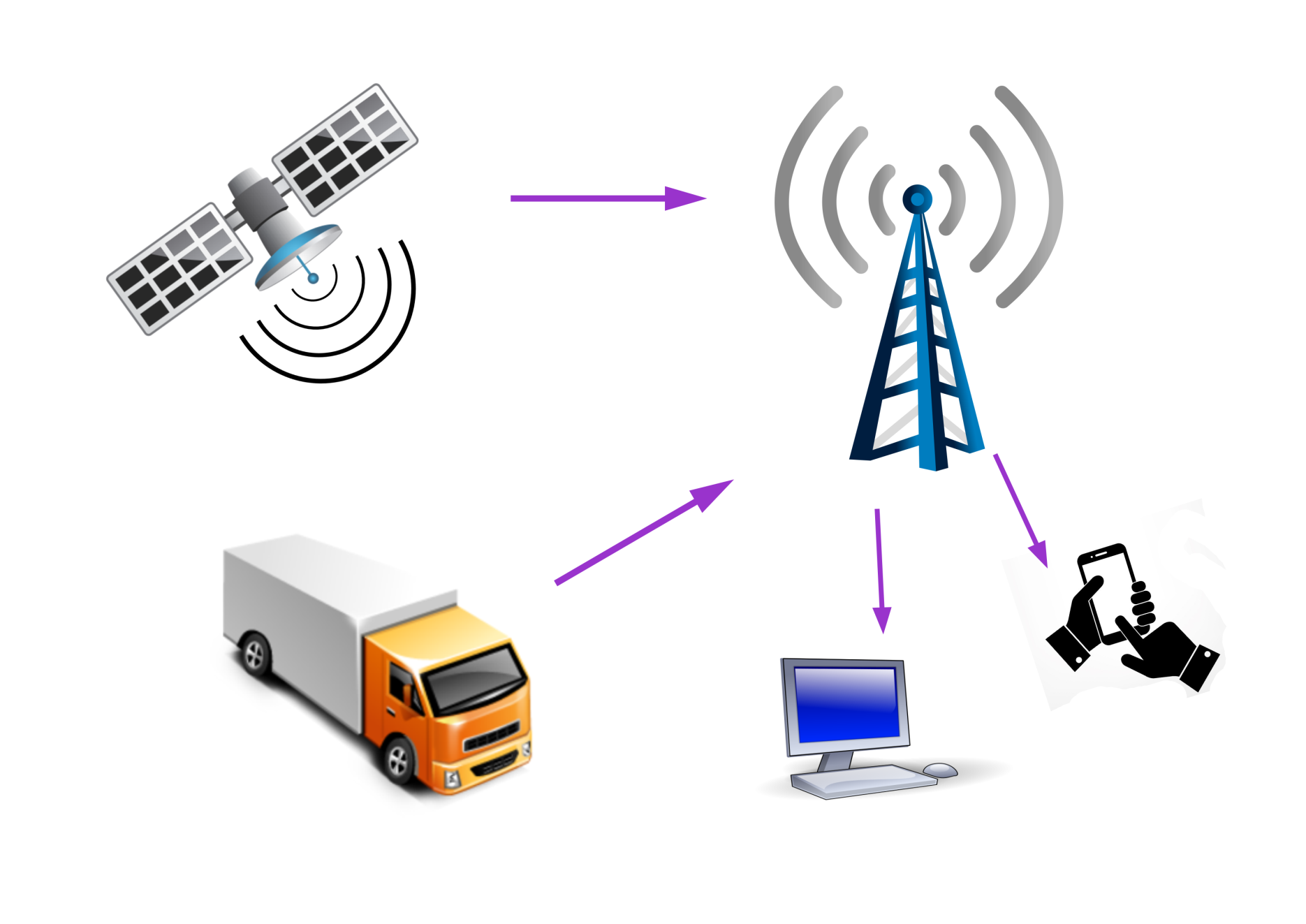

GST - CBEC has issued Draft Rules on E-Way bill

Central Board of Excise and Customs (CBEC) has issued draft rule on Electronic way bill which requires registered entities to upload in a prescribed format on the GSTN website the details of movement within a state or outside the State of any goods of a value exceeding Rs. 50,000.

The entire process requires participation by the supplier, the transporter and the recipient, if he is a registered person.

Click to download the GST Draft

Rules on E-Way Bill.

We are of the view that initially the requirement of E-Way Bill may first be applied to sensitive, evasion-prone commodities instead of making it mandatory across all commodities as small entities with poor internet connectivity will find difficult to comply.

Click to view note on compliance required under the GST draft rules on E-Way bill

GST - Draft Rules on Assessment and Audit issued by CBEC

Central Board of Excise and Customs (CBEC) has issued draft rule on Assessment and Audit.

Click to download the GST Draft rules on Assessment and Audit.

However public comments on these are invited by April 21. The GST council will finalise the draft rules in their meeting in May, 2017.

GST - Revised Draft Rules on filling of Returns issued

Central Board of Excise and Customs has made available in its website the revised draft rule on filing of Returns.

Click to download the revised GST draft rules on filing of Returns.

Date : April

15, 2017.