Will GST Bill be passed by the Rajya Sabha ?

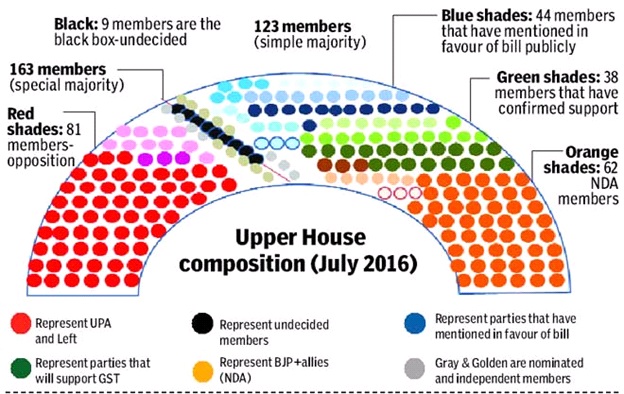

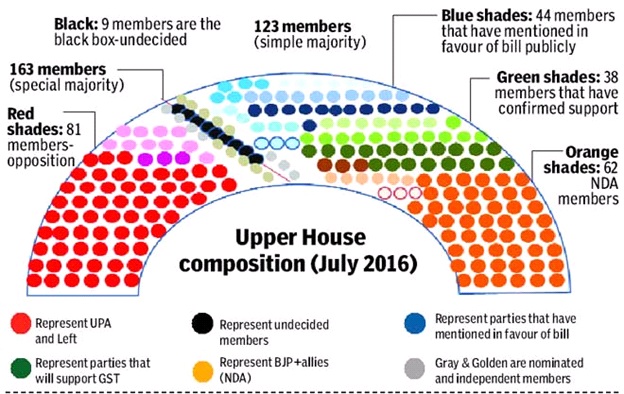

We read several reports speculating of whether the Government has the numbers to see the GST Bill through in the Rajya Sabha in the Monsoon Session.

With the session starting on 19th July 2016, reports suggested that the Bill would be taken up for discussion at the start of the Session. However it may not happen going by the statement of Sri Anand Sharma who has stated that preliminary discussion had happened. He said, “The talks are on. We will brief our leadership and will meet again after the session starts.” To a question on whether GST Bill would be passed in the monsoon session, he said that the ball is on their (Government) court and if the response is satisfactory they would consider supporting.

The Congress Party seems to have softened their stand on specifying the maximum GST Rate of tax in the Constitution Amendment Bill. Their position now is that the GST Rate is to be “Ring Fenced”, which means that maximum GST Rate of tax may be specified in the GST Act.

On the issue relating to the mechanism for resolution of disputes between the Central Government and the States or between States, nothing much has been stated recently by the Congress Party.

Considering that the vote of the AIADMK members would be crucial for the passage of the GST Bill, the views of the Chief Minister of Tamil Nadu, Jayalalitha in her speech read out in the recent meeting of Inter State Council is relevant. She said,

“On Goods and Services Tax, the Punchhi Commission has made certain recommendations that fully support the stand taken by the Government of Tamil Nadu. Tamil Nadu’s demands that revenue neutrality must be ensured, a consensus must be reached on the revenue neutral rate and assurance of providing 100 per cent compensation to States for revenue loss before proceeding with the Constitutional Amendment Bill, finds resonance in the Commission’s recommendations. The recommendation on subjecting polluting inputs and outputs, petroleum products, alcoholic beverages and tobacco products to non-rebatable levy is also in line with Tamil Nadu’s demand to keep Petroleum products out of GST and to enable States to levy additional taxes on tobacco and tobacco products. On the issue of institutionalizing the mechanism to implement GST, the Punchhi Commission has very approvingly cited the functioning of the Empowered Committee of State Finance Ministers and called for making this arrangement permanent. This has also been Tamil Nadu’s stand,”

We understand from the speech that Jayalalitha per se is not opposed to the Constitution Amendment Bill but has only highlighted certain safeguards.

It appears that the 14 AIADMK members may either vote in favour or may abstain, which would narrow down the gap in required favourable votes.

The moot question is, is it just a numbers game or should the GST Bill be passed by consensus with the support of the Congress party.

However confidant the Government may be on passing the bill with or without the support of Congress, it is important that being a monumental reform, the Bill is passed by consensus with the support of the Congress party.

With recent political developments and going by the disruptive stance of the Congress party in the recent past, it is possible that the Congress party would not actively cooperate and we may look forward to a stormy session.

Let us hope the Government placates the Congress party and manages to pass the GST Bill

Date : 18th July, 2016

Image courtesy: financialexpress.com