The current standard rate of VAT is 17.5%, which is one

of the lowest rates in Europe.

|

Country |

VAT % |

Country |

VAT % |

Country |

VAT % |

|

Source: European Commission |

|

Austria |

20 |

Germany |

19 |

Netherlands |

19 |

|

Belgium |

21 |

Greece |

23 |

Poland |

22 |

|

Bulgaria |

20 |

Hungary |

25 |

Portugal |

20 |

|

Cyprus |

15 |

Ireland |

21 |

Romania |

19 |

|

Czech Republic |

20 |

Italy |

20 |

Slovakia |

19 |

|

Denmark |

25 |

Latvia |

21 |

Slovenia |

20 |

|

Estonia |

20 |

Lithuania |

21 |

Spain |

16 |

|

Finland |

22 |

Luxembourg |

15 |

Sweden |

25 |

|

France |

19.6 |

Malta |

18 |

UK |

17.5 |

It has been suggested that increasing VAT would be a

good way for the coalition government to raise some of

the extra cash it needs to reduce the amount it has to

borrow.

If the government were to raise the rate of VAT from

17.5% to 18.5% it would raise about £4.65bn.

Because many necessities are zero-rated for VAT, the

government could argue that the increased tax would not

harm the most vulnerable people in society.

|

|

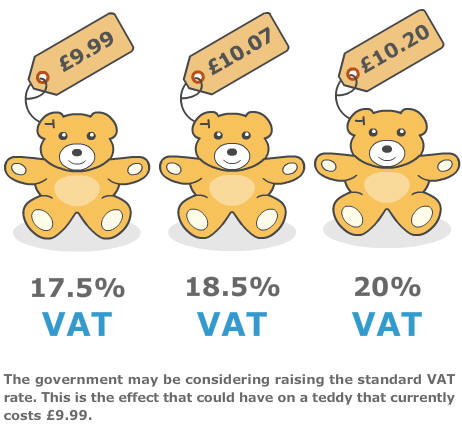

17.5% |

18.5% |

20% |

|

Cuddly toy |

£9.99 |

£10.07 |

£10.20 |

|

Flat-screen television |

£500.00 |

£504.25 |

£510.64 |

|

New car |

£15,000.00 |

£15,127.66 |

£15,319.15 |

But the government could decide that desperate times

call for desperate measures and begin to charge VAT on

items that have previously been zero-rated.

Last year, £71.5bn was spent on food in the UK,

according to the Office for National Statistics.

So, if the government were to start charging VAT on

food, it would make about £700m for every 1% it charged.

If the government felt really brave and decided to

charge the full 17.5% VAT rate on clothes and shoes for

small children it could raise about £1bn a year,

according to HMRC.

Alternatively, it could charge full VAT on newspapers,

books and magazines and raise £1.3bn.

Of course, all of these figures for VAT ignore the

possibility that higher prices would mean people would

buy fewer of the more expensive items.