Welcome aboard gstindiaonline.com

June 2010

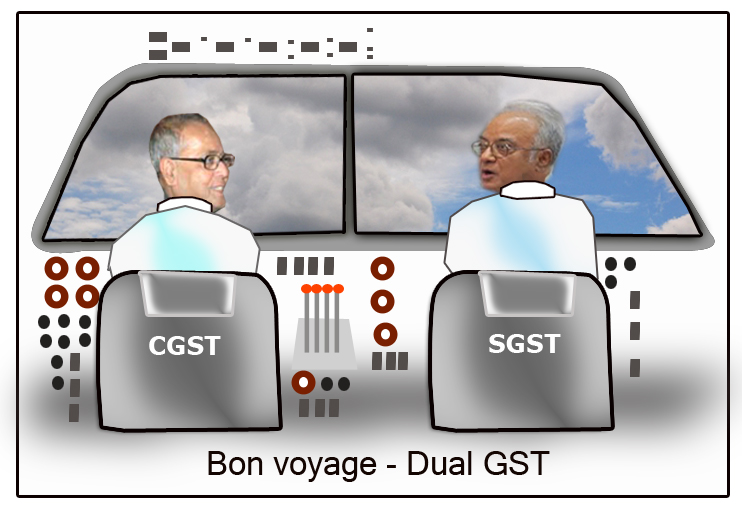

Union Finance Minister Sri Pranab Mukherjee

and Chairman of Empowered

Committee of State

Finance Ministers Dr. Asim Kumar Dasgupta

OUR MISSION

This is the captain of gstindiaonline.com welcoming you aboard.

It is our cherished desire to be your official carrier to transship you from the beaten track of CENVAT and State VAT to the uncharted terrain of a Dual GST regime. The journey will be turbulent with lot of air pockets like Compensation to States, Transitional issues, Treatment of existing Tax Concession, difficulties in drafting an appropriate GST legislation and so on.

The landing is not expected to be very smooth. We, at gstonlineindia.com, have started on this journey with a mission to provide you with the latest developments relating to GST. We seek to serve as a link between the tax payer and the tax administrator to help design a practical GST and to make the transition smooth.

We set up www.stvat.com in 2001 with an identical objective with regard to State VAT. We may mention that we contributed our 2 cents worth, with the active participation of tax professionals and Tax Administrators from across India.

We, once again Welcome you to your own mini portal on GST in India. Yes, we choose to call this your portal because the success of establishing this portal depends on the participation by all those who will be affected by the implementation of GST.

This portal has been designed to be a comprehensive resource on GST initiatives and issues. The portal will highlight GST information relevant to traders, manufacturers, exporters, consumers and tax administrators.

TOWARDS PRACTICAL GST

There is no standard design of GST and it is often said that �No one size fits all�. Each country has to design the model that is best suited to its business and political environment.

The Dual Structure GST that is proposed to be implemented appears to be the best compromise, though a single GST would be ideal.

Unlike at the time of implementation of State VAT, there is no visible resistance from the trade fraternity. The hitch, at the moment, is the issue of compensation to the States and once it is out of the way, we believe that the momentum towards meeting the deadline would pick up.

Irrespective of the uncertainty on the date of implementation of GST, it is a fact that GST will replace the present system of taxation.

Though GST implementation is a process and is not an event, it is best to highlight issues and draft the legislation as practically as possible initially. Putting through amendments is a tedious process as would have been your experience in correcting anomalies / impractical provisions in State VAT legislations.

We believe that it is the combined responsibility of all stake holders viz., consumers, tax administrators, tax professionals, manufacturers and traders, to play a constructive role in designing a practical GST.

CALLING TAX PROFESSIONALS IN INDIA AND OVERSEAS

We request tax professionals to actively participate in the initiative and contribute articles on design of GST, planning transition, Impact on Supply Chain and so on.

We also call upon tax professional in other jurisdictions like Australia, UK, Canada and other countries to join us and help us in understanding International tax treatment of transactions and Transitional issues.

We also intend to seek the assistance of reputed overseas professionals and invite them to contribute content to the portal.

EDITOR

Sri S. Sridharan, Chartered Accountant with over 30 years experience in both direct and indirect taxes has agreed to be the honorary editor and will be writing a column on various aspects of GST. S.Sridharan is principal consultant to STVAT Consulting that operates through a network of consultants across India.

LET US REACH OUR GOAL

We, at gstindiaonline.com, have taken the first step to launch the site and it is your responsibility to keep the site upto date so that all of us can contribute to reach the goal of achieving a practical GST.

Please participate actively.

Date : 6th

June, 2010